Student Loan Burdens Among Teachers

Why address student loan debt for teachers?

Recruiting and retaining a well-prepared, stable, and diverse teacher workforce is critical to student learning. However, persistent teacher shortages across the nation’s schools—influenced by the quality and affordability of teacher preparation and credentialing, job-related stress, and compensation—hamper this mission. As suggested by prior research, the student loan debt incurred to become and stay a teacher is intertwined with these factors.

Nearly all states require that teachers have at least a bachelor’s degree to earn a standard initial teaching license and require teacher candidates to complete an approved teacher preparation program. Additionally, career advancement can require further investment in higher degrees or additional credentials, which have become increasingly expensive, with the costs of postsecondary education growing by nearly 50% over the past 2 decades.

While the federal government offers some supports to defray the costs of becoming a teacher—including the Public Service Loan Forgiveness, Teacher Loan Forgiveness, and TEACH grant service scholarship programs—these supports are not sufficiently sizable or widely available to offset costs for most teachers. As a result, teacher candidates often must decide between taking on student loans, entering teaching through alternative preparation routes that allow them to train while teaching—but are associated with higher turnover—or deciding not to pursue a teaching career. Teachers plagued with large student debts experience considerable stress, must often work two jobs, and may decide to leave the profession early or not pursue advanced credentials.

What is the scope of teachers’ student loan debt?

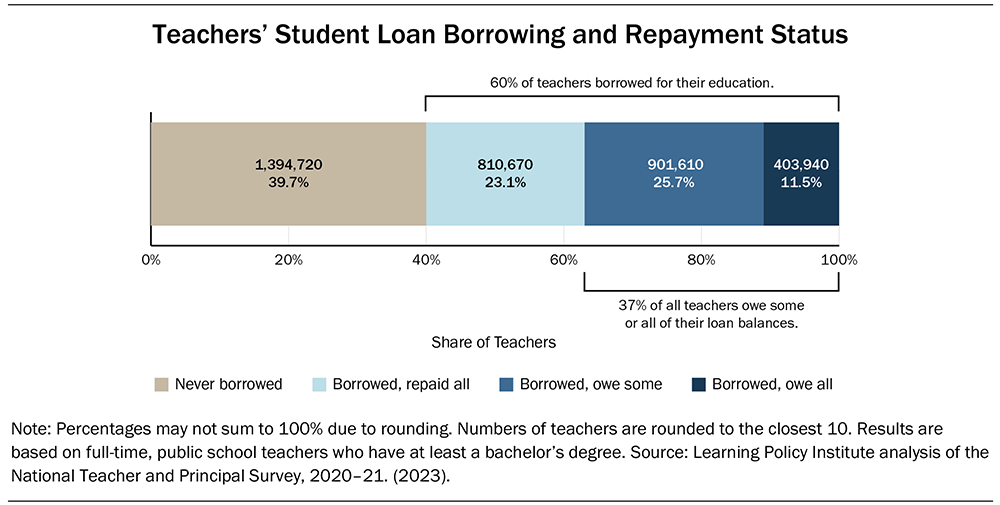

The most recent federal data show that 60% of teachers borrowed for their education and nearly 40% have outstanding student loans on which they pay an average of $342 per month. Among those who completed an education program in 2020 and took out student loans, the average amount owed in loans was $29,250 for a bachelor’s degree, $38,230 for a master’s degree, and $42,480 for a postbaccalaureate degree.

Nearly one third of teachers who have student loans still owe their full balance. Moreover, despite the promise of loan cancellation in exchange for teaching service, about 30% of teachers with 16–20 years of teaching experience have student loan debt—well beyond the service requirement for federal loan forgiveness programs. This could signal potential barriers in information about access to, or operation of, federal programs such as Teacher Loan Forgiveness and Public Service Loan Forgiveness.

Student loan debt affects all groups of teachers but disproportionately impacts beginning teachers, special education teachers, and Black teachers. Notably, about 71% of Black teachers have taken out student loans, with almost 60% still owing on their loans and 31% still owing their entire balance. This is nearly 3 times larger than the share of all teachers who owe their full balance.

Why does student loan debt matter?

Student loan burdens may contribute to teacher shortages and influence the workforce in several ways, including:

The pipeline into teaching

-

Student loan debt may dissuade individuals from pursuing teaching as a career altogether.

-

The prospect of accumulating student loan debt could deter people from pursuing high-quality, comprehensive preparation programs, in which candidates work alongside an expert teacher during student teaching or a residency while taking integrated coursework. Prospective teachers may, instead, choose fast- track preparation programs that skip student teaching and typically have higher teacher turnover rates.

The current teacher workforce

-

The average teacher's salary is about 27% less than that of other college graduates. Teachers' incomes are further reduced when student loan repayments are layered on top of these lower salaries. Compensation affects both recruitment and retention in teaching.

-

About 1 in 5 teachers work multiple jobs because of their student loan debt, which influences both the time teachers can commit to their work and their efficacy and satisfaction, which affects retention.

-

More than 60% of teachers who have student loan debt feel highly or very highly stressed about their loans. Teachers with very high loan-related stress levels are more likely to report feeling stressed and disappointed with their jobs, a major predictor of attrition.

-

Student loans could discourage teachers from earning advanced degrees or credentials.

What can policymakers do?

Reducing the financial barriers related to entering and staying in the profession is important to building and maintaining a well-prepared, stable, and diverse teacher workforce. Policy approaches include:

-

Expand and improve the administration of service scholarship and loan forgiveness programs, including increasing service scholarship awards, having loan forgiveness programs make federal student loan payments for teachers until they are eligible to retire their debt completely, and improving program administration to more seamlessly deliver on their promise for those engaged in teaching service.

-

Expand the affordability and availability of high-retention preparation pathways—such as residency and many Grow Your Own programs—that offer high-quality preparation along with financial support.

-

Increase teachers’ total compensation to bolster their capacity to repay their student loans. Teachers’ net compensation can be augmented through salary increases as well as with tax credits and housing subsidies.

-

Incentivize and underwrite the costs of earning advanced credentials in shortage areas, which may help avoid additional debt, improve compensation, incentivize the service of accomplished teachers in areas of high need, and enhance teacher satisfaction and retention.