In Debt: Student Loan Burdens Among Teachers

The resumption of federal student loan repayments after a three-and-a-half-year hiatus during the COVID-19 pandemic comes at a time in which teachers are facing myriad stressors—rising teacher preparation costs, relatively lower teacher pay compared to other professions that require equivalent levels of educational attainment, and heightened job-related stress. The consequences of student loan debt are wide reaching and can affect choices about preparation and credentialing, prospective teachers’ desires to enter the profession, and current teachers’ potential decisions to leave the profession.

Using data from the National Teacher and Principal Survey from 2020–21, this report describes the state of student loan borrowing and repayment among full-time, public school teachers and explores whether student loan burdens differ by teacher characteristics. The analyses also examine the extent to which student loan debt is associated with teachers’ well-being and employment decisions. The report concludes with recommendations that support the expansion of programs that alleviate or minimize the costs of comprehensive teacher preparation and credentialing; improve teaching conditions; and promote high quality preparation, career advancement, and retention.

Findings

Most teachers have taken out student loans to support their education. Just over 60% of all full-time, public school teachers—about 2.1 million—have taken out student loans to pay for their education. Rates of borrowing among teachers are similar to the borrowing rates of all individuals who have recently completed a bachelor’s or a master’s degree. Among all teachers, 55.5% of teachers with a bachelor’s degree and 63.2% of teachers with a master’s degree have ever borrowed for their education, while 60.8% of all individuals who completed a bachelor’s degree and 66.2% of those who completed a master’s degree in any major in 2020 had taken out student loans. However, the borrowing rates among program completers who majored in education are higher than the average program completer in any major at both the bachelor’s (75.9%) and master’s (76.4%) degree levels of educational attainment.

Many teachers are still repaying their student loans. Roughly 1.3 million teachers are repaying their student loans, suggesting that the resumption of student loan repayments affects close to 4 of every 10 teachers (37.2%), nearly one third of whom (11.5% of all teachers) still owe their entire balance. As expected by the typical timing and structure of student loans and teachers’ ability to repay over time, the portion of teachers who carry loan balances decreases as teachers age and gain teaching experience. Still, a sizeable portion of teachers carry loan debt well into their careers: For example, almost 2 of every 10 teachers over 61 years old are still repaying loans. On average, teachers who were repaying their student loans report paying $342 a month, which exceeds the amount the typical borrower pays toward their student loans monthly ($200–$299).

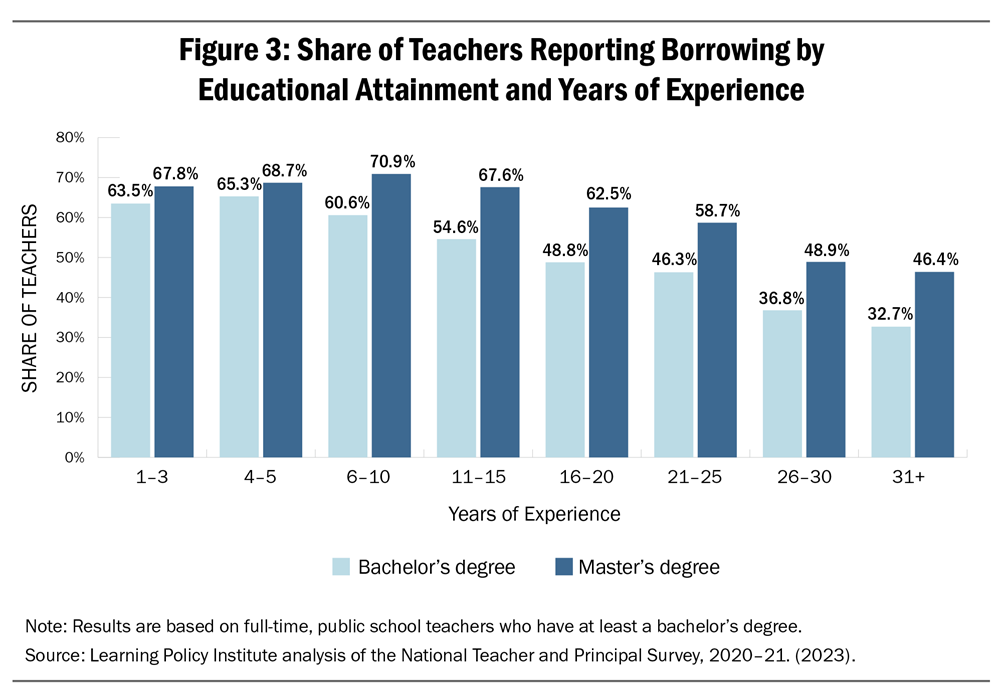

Student loan debt is widespread, affecting all groups of teachers, but beginning teachers, special education teachers, and Black teachers are more likely to have taken out loans and to still owe payments. The need for borrowing appears especially acute for newer teachers: Around 65% of teachers in their first 10 years of teaching have ever taken out loans, compared to about 41% of teachers with more than 30 years of experience (see Figure 3). The higher reliance on loans over time may reflect the rising costs of preparation and credentialing, and it comports with overall trends on student loan borrowing rates over time. It may also be that teachers who took out student loans are more likely than their peers who did not take out a student loan to leave the profession before they become highly experienced.

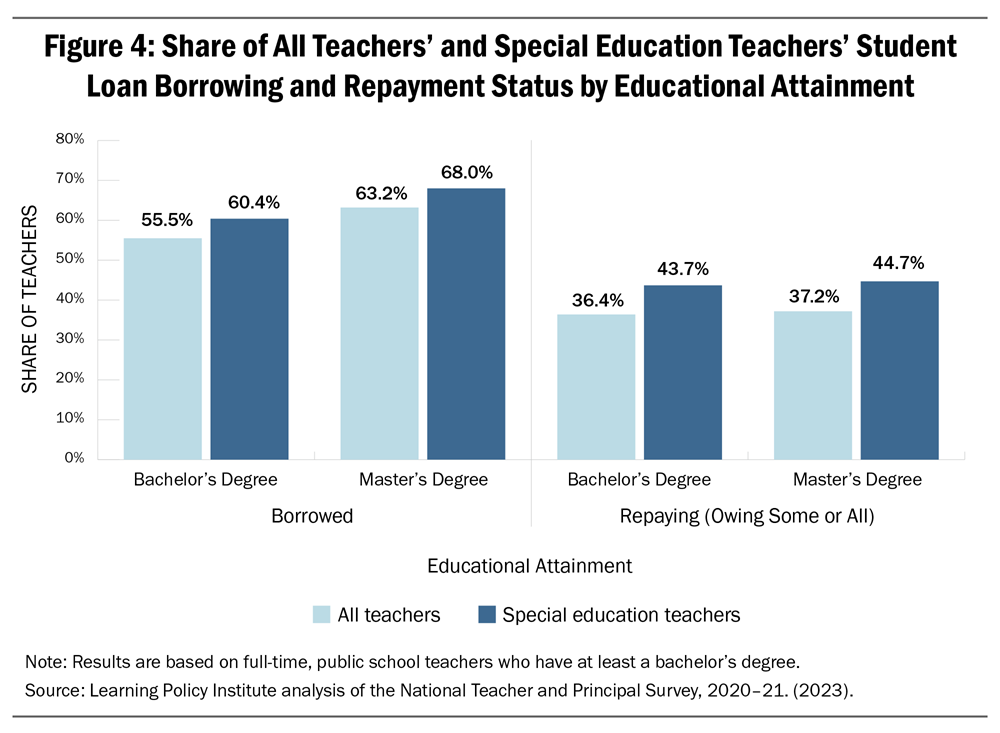

Compared to teachers in other subject areas, special education teachers are the most likely to have ever taken out student loans (65.2%) and the most likely to owe their entire balance (15.4%) (see Figure 4). Many special education teachers obtain a master’s degree or other advanced degrees after they have earned a bachelor’s degree and licensure, resulting in more costs and, potentially, increased borrowing and repayment amounts to teach in a subject area that is facing one of the most intense shortages nationwide.

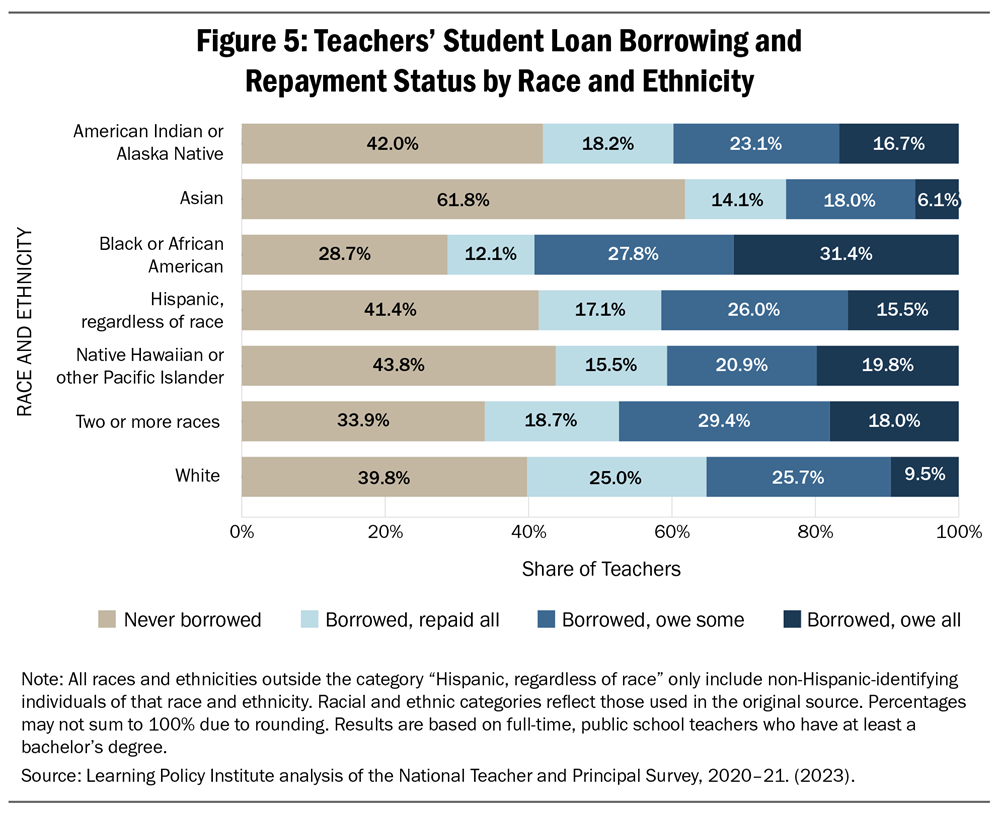

Relative to other racial and ethnic groups studied, the rates of student loan borrowing and repayment are the highest among Black teachers, with about 71% of Black teachers having ever taken out student loans, and almost 60% still in repayment. Moreover, 31.4% of all Black teachers still owe their entire balance—close to 3 times larger than the share of all teachers who owe the full amount (see Figure 5). These disparities of loan debt hold true across levels of educational attainment and continue as teachers gain experience, signaling potential systemic barriers that make Black teachers more reliant on student loans and more likely to hold debt, and potentially posing a barrier for districts that are seeking to diversify their workforce.

Many teachers have worked multiple jobs because of their student loan debt. Over a third of borrowing teachers (36.7%) reported having worked multiple jobs at the same time because of their student loans. The proportion of teachers having worked multiple jobs is larger for those with larger monthly repayment bills.

Most teachers who are repaying their student loans report high levels of loan-related stress. About 60% of teachers who have outstanding loans reported high or very high levels of stress due to their student loan debt. Only about 14% of teachers who are repaying their loans reported that their loan-related stress levels were low or very low.

Student loans for teachers in repayment are correlated with their overall job-related stress. Larger shares of teachers who indicated high or very high levels of loan-related stress reported feeling stressed and disappointed with their jobs, compared to teachers who felt less stressed by loans.

Policy Recommendations

There are multiple policy approaches at the federal, state, and local levels that could reduce student loan debt burdens for prospective and current teachers and help support the recruitment and retention of a diverse teaching workforce. These include:

- Expand loan forgiveness and service scholarship programs to reduce student loan–related financial strains and to strengthen recruitment and retention.

- Expand the affordability and availability of high-retention preparation pathways.

- Increase teachers’ salaries to bolster their capacity to repay their student loans.

- Bolster teachers’ net compensation through tax credits and housing subsidies.

- Incentivize and underwrite the costs of earning high-need, advanced credentials.

With over 90% of outstanding student loans being administered or held by the U.S. Department of Education, the federal government is in a particularly strong position to directly address teachers’ loan-induced financial strains.

In Debt: Student Loan Burdens Among Teachers by Emma García, Wesley Wei, Susan Kemper Patrick, Melanie Leung-Gagné, and Michael A. DiNapoli Jr. is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This research was supported by the Carnegie Corporation of New York and the Skyline Foundation. Core operating support for LPI is provided by the Heising-Simons Foundation, William and Flora Hewlett Foundation, Raikes Foundation, Sandler Foundation, and MacKenzie Scott. We are grateful to them for their generous support. The ideas voiced here are those of the authors and not those of our funders.